NFTs in Research Funding: How Science Is Driving Innovation

Introduction

Non-fungible tokens (NFTs) have rapidly expanded beyond their roots in digital art and collectibles, emerging as transformative tools in the world of scientific advancements with NFTs in research funding. Traditionally, research projects rely heavily on grants from institutions, governments, or private organizations, processes often marked by complexity, delays, and limited accessibility. However, the rise of blockchain technology and NFTs is disrupting this paradigm by enabling researchers to tokenize their projects as unique digital assets, opening new avenues for fundraising, engagement, and collaboration.

By leveraging NFTs, scientists can connect directly with supporters worldwide, democratizing access to research funding and increasing transparency. This blog explores the many ways NFTs are empowering researchers to fund innovation, facilitate data sharing, and transform the scientific landscape.

NFTs as a Revolutionary Funding Tool for Science

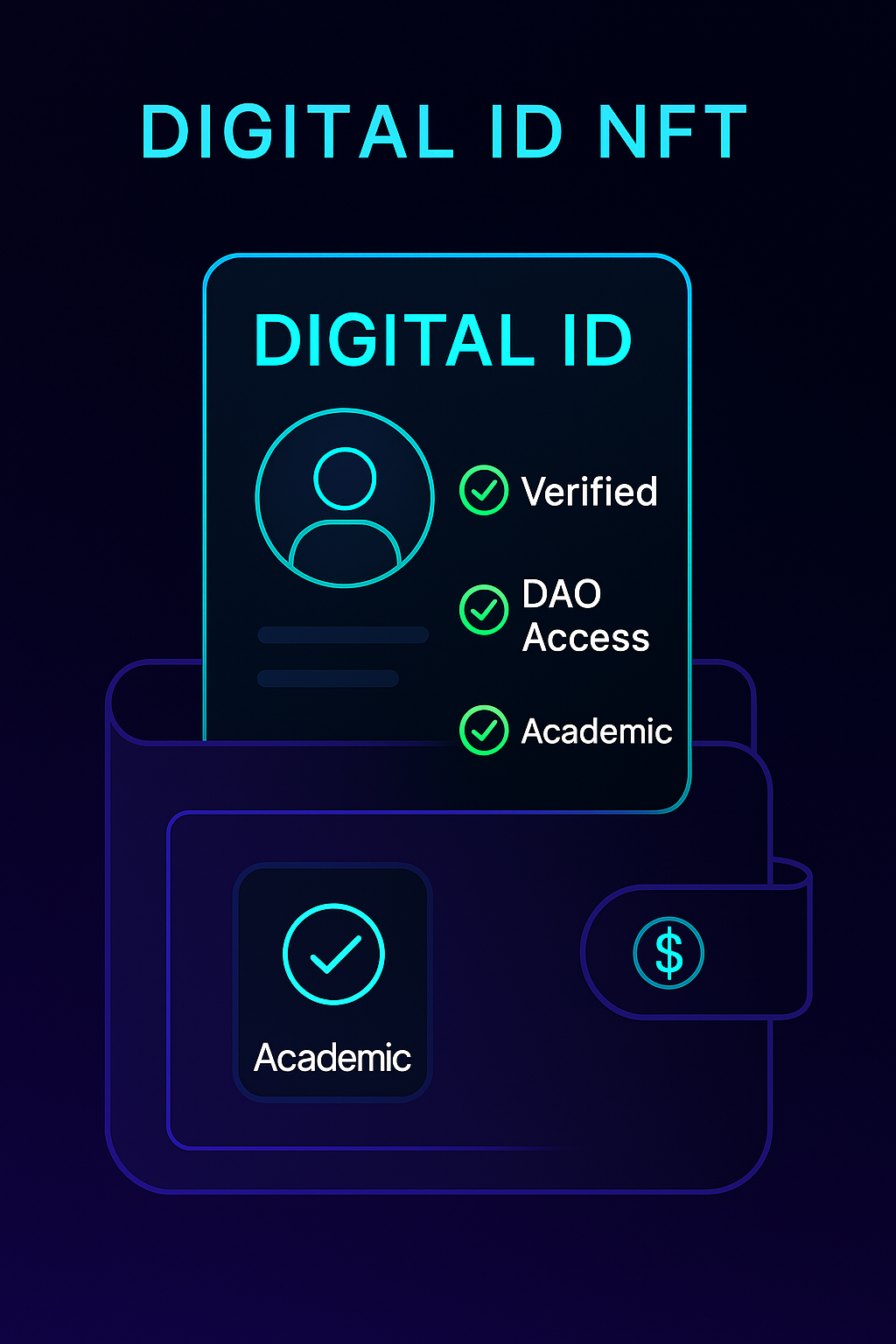

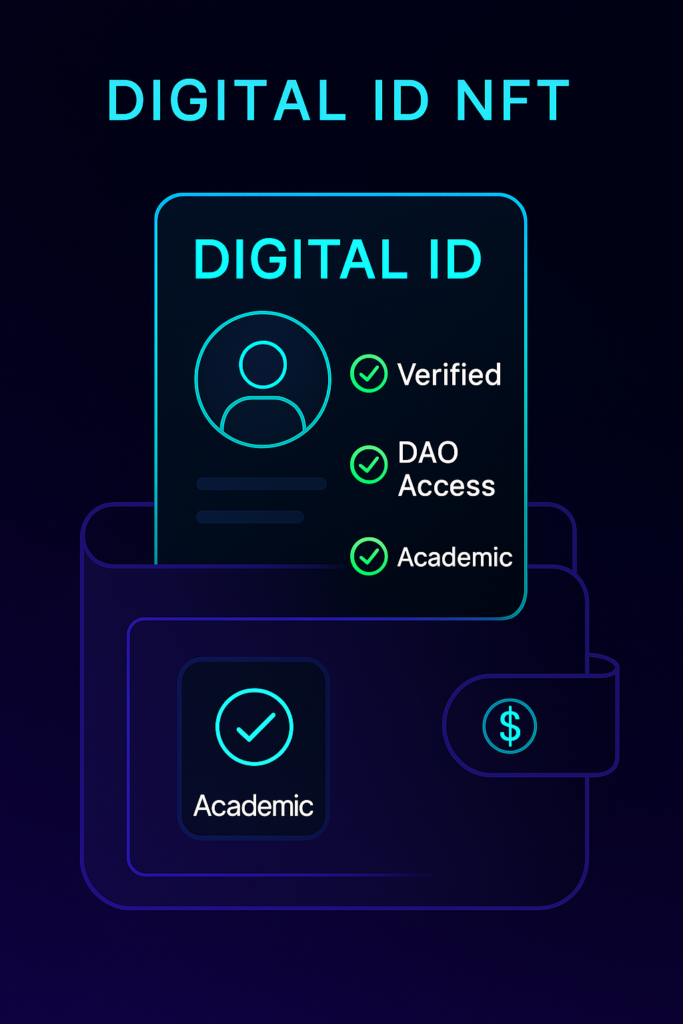

NFTs, by their nature, represent unique digital assets verified on a blockchain. When applied to NFTs in research funding, NFTs can symbolize ownership, support, or access rights tied to a specific scientific project. Unlike traditional funding models, NFT-based fundraising offers:

- Direct interaction: Researchers engage directly with supporters without intermediaries.

- Global reach: Anyone, from enthusiasts to investors, can participate in funding.

- Transparency: Blockchain ensures clear, tamper-proof records of contributions.

- Ownership and perks: NFT holders can receive exclusive benefits such as early access to findings, voting rights on project directions, or personalized acknowledgments.

This new funding model not only accelerates capital inflow but also builds a loyal community around scientific innovation.

Expanding Funding Opportunities

Small-scale projects or emerging fields often struggle to secure grants through conventional routes. NFTs in research funding level the playing field by allowing even niche research to attract micro-investments globally. This inclusion can lead to faster progress in areas like climate science, medical research, or renewable energy technologies that may be overlooked by large funding bodies.

Community Engagement & Crowdfunding 2.0

NFTs transform backers into stakeholders. Supporters feel personally connected and invested in the success of research projects. This communal involvement incentivizes long-term support and knowledge sharing, which is crucial for complex, iterative scientific work.

Blockchain-Based Research Grants and Smart Contracts

Blockchain technology underpins NFTs with security and automation. Smart contracts, self-executing agreements coded on the blockchain, can facilitate:

- Automated fund release: Payments are unlocked as research milestones are verified, ensuring accountability.

- Conditional ownership: NFTs can grant access or rights only if certain criteria are met.

- Fractional investments: Multiple backers can own parts of the same NFT, diversifying risk.

Smart contracts reduce bureaucracy and speed up funding cycles, creating a more efficient grant system.

Example: NFT-Backed Scientific Grant Platforms

Several platforms have begun implementing NFT-based grants where researchers auction NFTs tied to their projects. Investors receive tokens representing stakes in the outcomes or intellectual property. This pioneering approach blends crowdfunding with traditional grantmaking, bringing flexibility and new incentives.

Democratizing Research Funding: Inclusivity and Access

One of the greatest advantages of NFT funding lies in democratizing access to science financing. Traditional grants typically favor established institutions and researchers with networks. NFTs open doors to grassroots support from individuals, enthusiasts, and small investors.

- Global participation: Anyone with internet access can contribute, expanding the funding base.

- Lower entry barriers: Smaller contributions collectively support large-scale projects.

- Gamification: NFT platforms often integrate rewards, badges, or exclusive content, motivating continuous engagement.

This broad involvement helps diversify the research community and accelerates innovation in underfunded or emerging disciplines.

ALSO READ: NFT Algorithms and Smart Contracts Empowering Digital Art

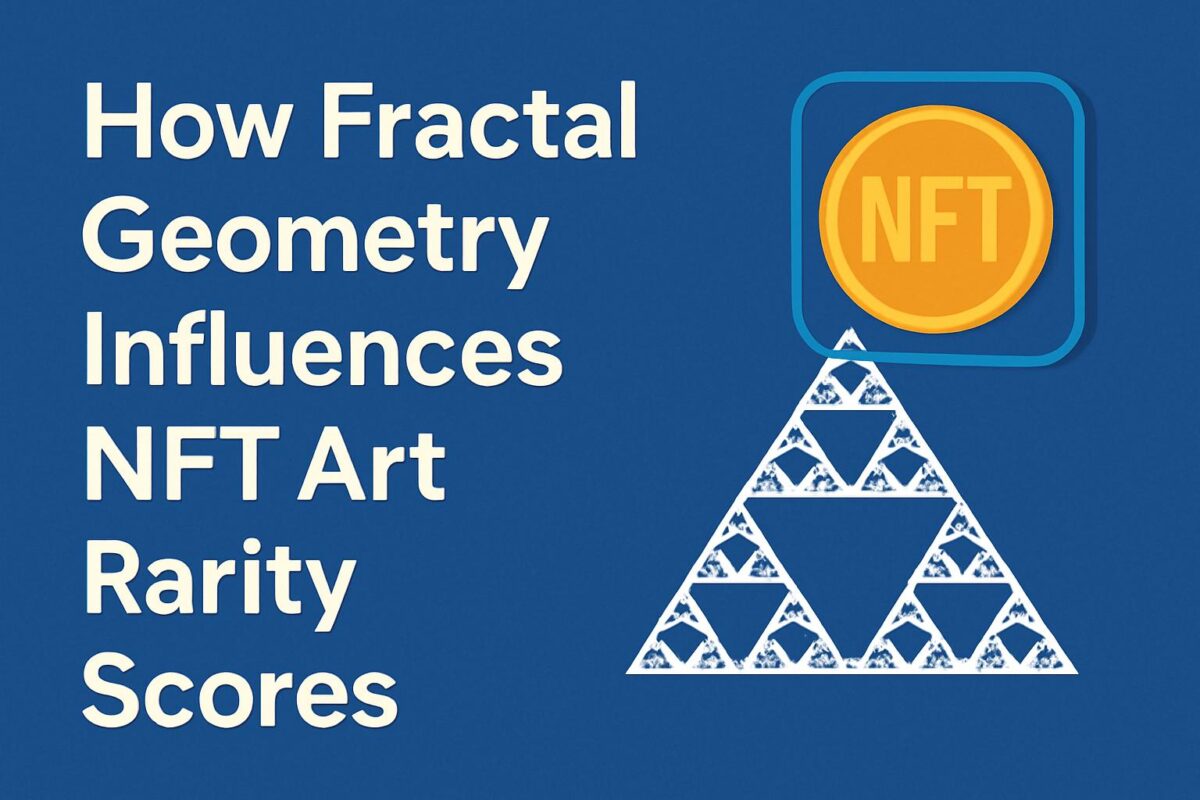

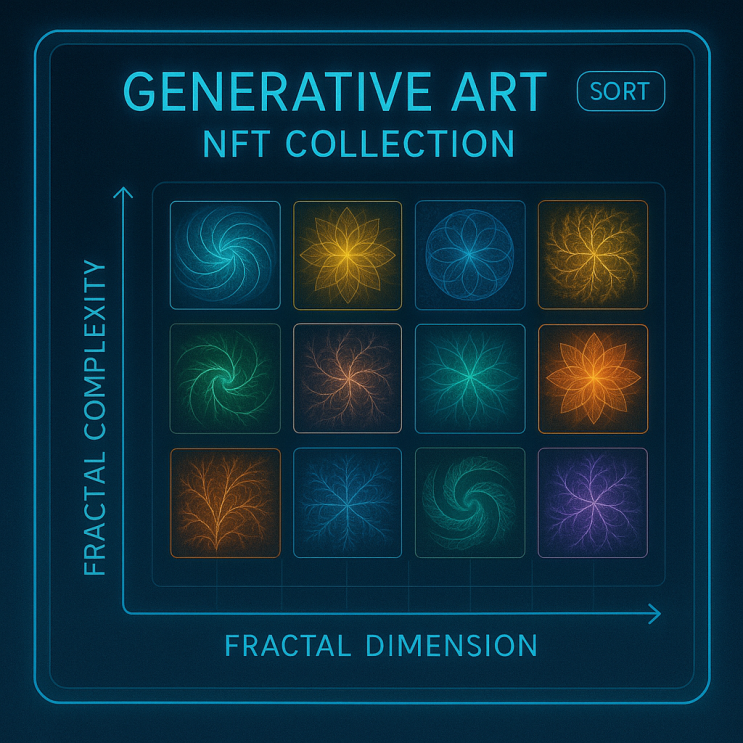

Scientific NFTs as Valuable Digital Assets

Beyond fundraising, NFTs function as scientific assets themselves. They can encode:

- Research data sets

- Experimental protocols

- Patents or intellectual property

- Authorship and contribution records

Tokenizing scientific knowledge enhances transparency and traceability. It creates new marketplaces for licensing or collaboration, allowing researchers to monetize discoveries while retaining ownership and control. This shift fosters an open yet protected ecosystem for scientific progress.

Use Case: NFT Licensing for Research Tools

A team developing a new biotechnology technique might issue NFTs representing licenses to use their patented method. Buyers get verified rights on the blockchain, preventing unauthorized use and ensuring fair compensation.

Overcoming Challenges in NFT Research Funding

Despite the promise, NFT-based research funding faces hurdles:

- Regulatory uncertainty: Legal frameworks for NFTs and intellectual property are still evolving.

- Market volatility: NFT values can fluctuate, potentially impacting funding stability.

- Technical literacy: Both researchers and backers need understanding of blockchain technology.

- Ethical considerations: Balancing open science with monetization requires careful governance.

Ongoing efforts to standardize NFT protocols, improve user interfaces, and clarify regulations are helping address these issues. As awareness grows, NFT funding is expected to gain mainstream legitimacy.

Future Trends: Hybrid Models and AI Integration

Looking ahead, hybrid funding models combining NFTs with traditional grants may emerge. For example, government agencies or philanthropic organizations could issue NFT-backed grants, blending innovation with stability.

Additionally, AI tools integrated with NFT platforms can:

- Analyze funding trends

- Predict project success probabilities

- Optimize resource allocation

These technologies promise to further enhance scientific research funding efficiency and impact.

FAQs

Q1: How do NFTs help fund scientific research?

A1: NFTs allow researchers to tokenize projects and raise funds directly from a global supporter base through unique digital collectibles.

Q2: Can individuals participate in NFT-based research funding?

A2: Yes, NFTs democratize funding by allowing anyone to invest or support scientific projects, regardless of size.

Q3: Are NFT-backed research grants legally recognized?

A3: Legal recognition varies, but evolving regulations and blockchain standards aim to integrate NFT funding with traditional frameworks.

Q4: What benefits do NFTs provide beyond fundraising?

A4: NFTs can represent research data, patents, and licensing rights, enabling new markets and collaboration opportunities.

Call to Action (CTA)

🔬 Ready to support groundbreaking science through NFTs? Subscribe now for insights into NFT research funding, blockchain innovation, and the future of scientific discovery!