Utility NFTs: Real-World Use Cases Beyond the Hype

Introduction

For years, NFTs were known mostly for digital art and speculation. However, the landscape is evolving. Utility NFTs are introducing real-world value into the Web3 space—unlocking access, proving identity, rewarding users, and powering innovation across sectors. As the hype fades, utility NFTs are becoming the true foundation of sustainable blockchain adoption.

What Makes an NFT “Utility-Based”?

Unlike traditional NFTs that focus on collectibility or rarity, utility NFTs provide tangible benefits or functions. These may include:

- Access: Unlocking gated content, events, or communities

- Function: In-game use, loyalty rewards, or authentication

- Interoperability: Usable across multiple platforms or services

- Proof: Verifying identity, credentials, or ownership of real assets

In short, they go beyond “owning” something to actually doing something.

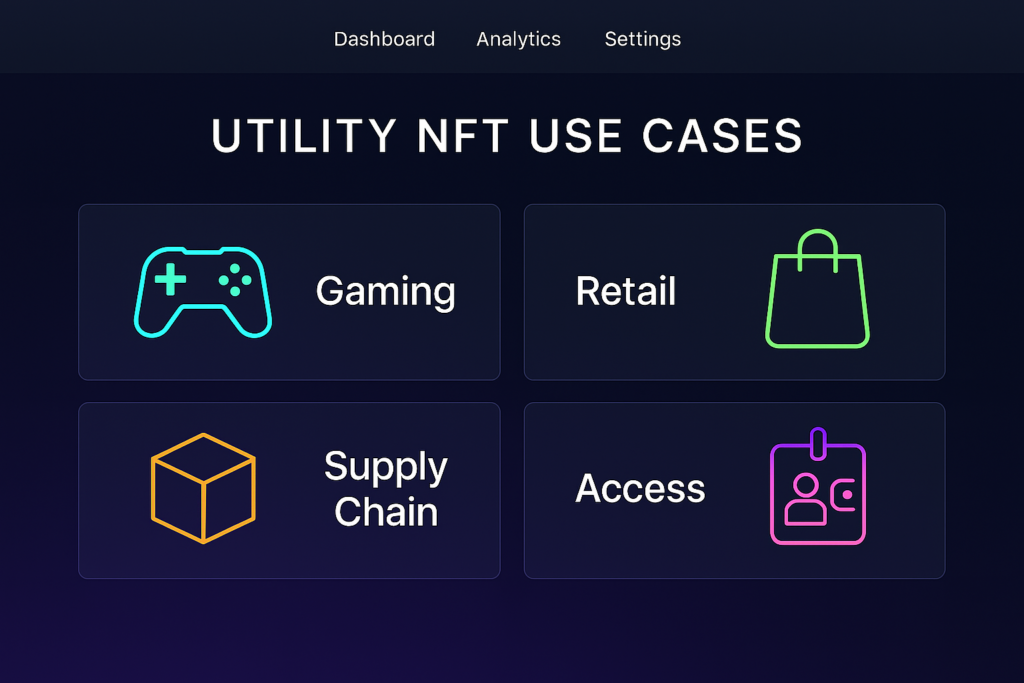

Top Real-World Applications of Utility NFTs

Utility NFTs are already at work across industries. Let’s explore how they’re reshaping value:

1. Event Access and Token-Gated Communities

NFTs now serve as digital tickets for concerts, conferences, and meetups. Brands like Coachella and VeeCon have launched NFT ticketing systems that unlock experiences both physical and digital.

Moreover, these tokens often grant lifetime or VIP access, turning a one-time ticket into an ongoing pass.

In communities, Discord and other platforms verify NFT holders to grant access to exclusive chat rooms, roles, or content. This token-gated system builds stronger, verified micro-communities.

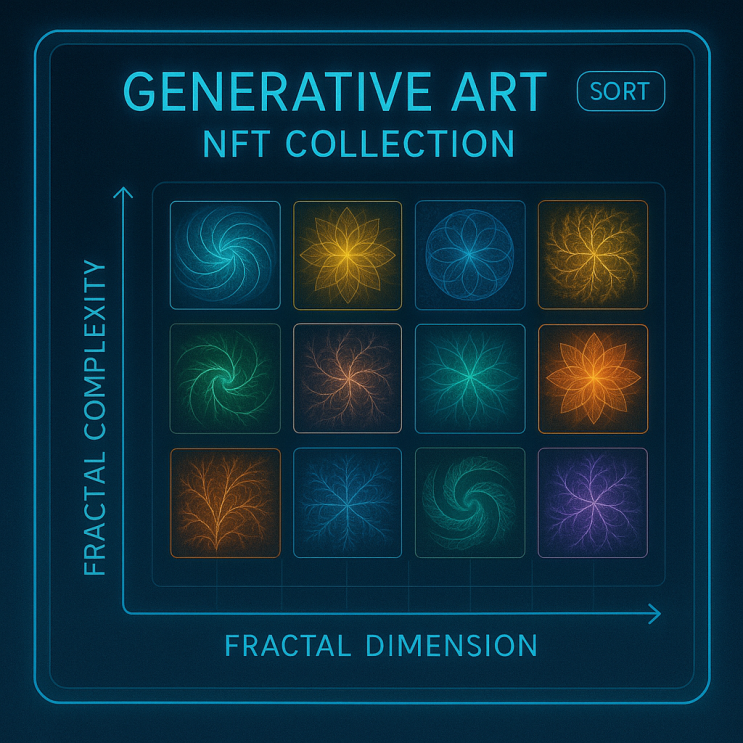

2. Gaming and Play-to-Earn Models

Gaming is one of the most dynamic sectors for utility NFTs. In-game NFTs act as weapons, avatars, skins, or even land. Unlike traditional digital items, NFT assets are truly owned, tradable, and usable across compatible ecosystems.

For example:

- Axie Infinity uses NFTs for characters in gameplay

- The Sandbox lets users buy, build, and monetize NFT-based virtual real estate

These NFTs often offer players both aesthetic customization and competitive advantages, making them more than just digital collectibles.

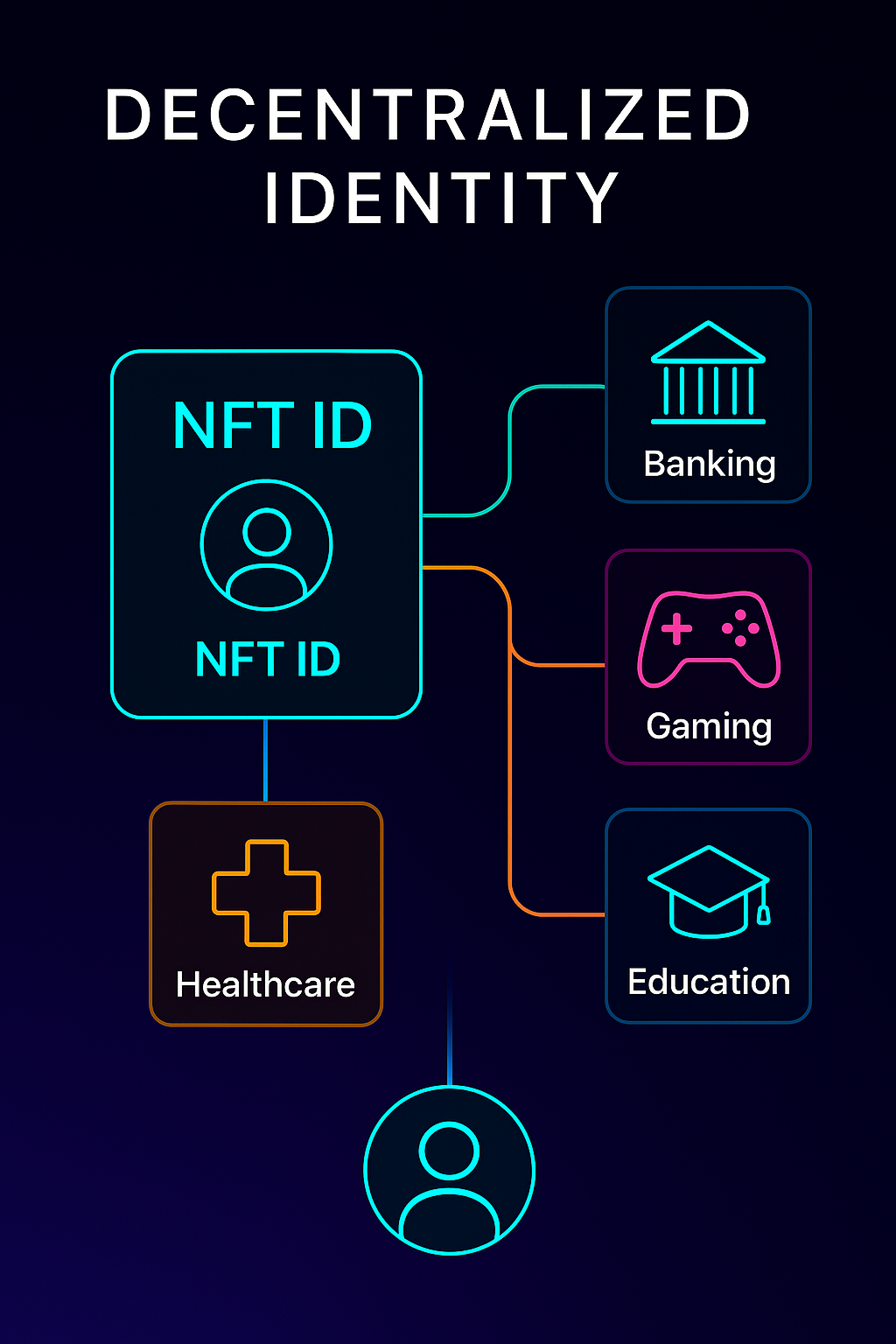

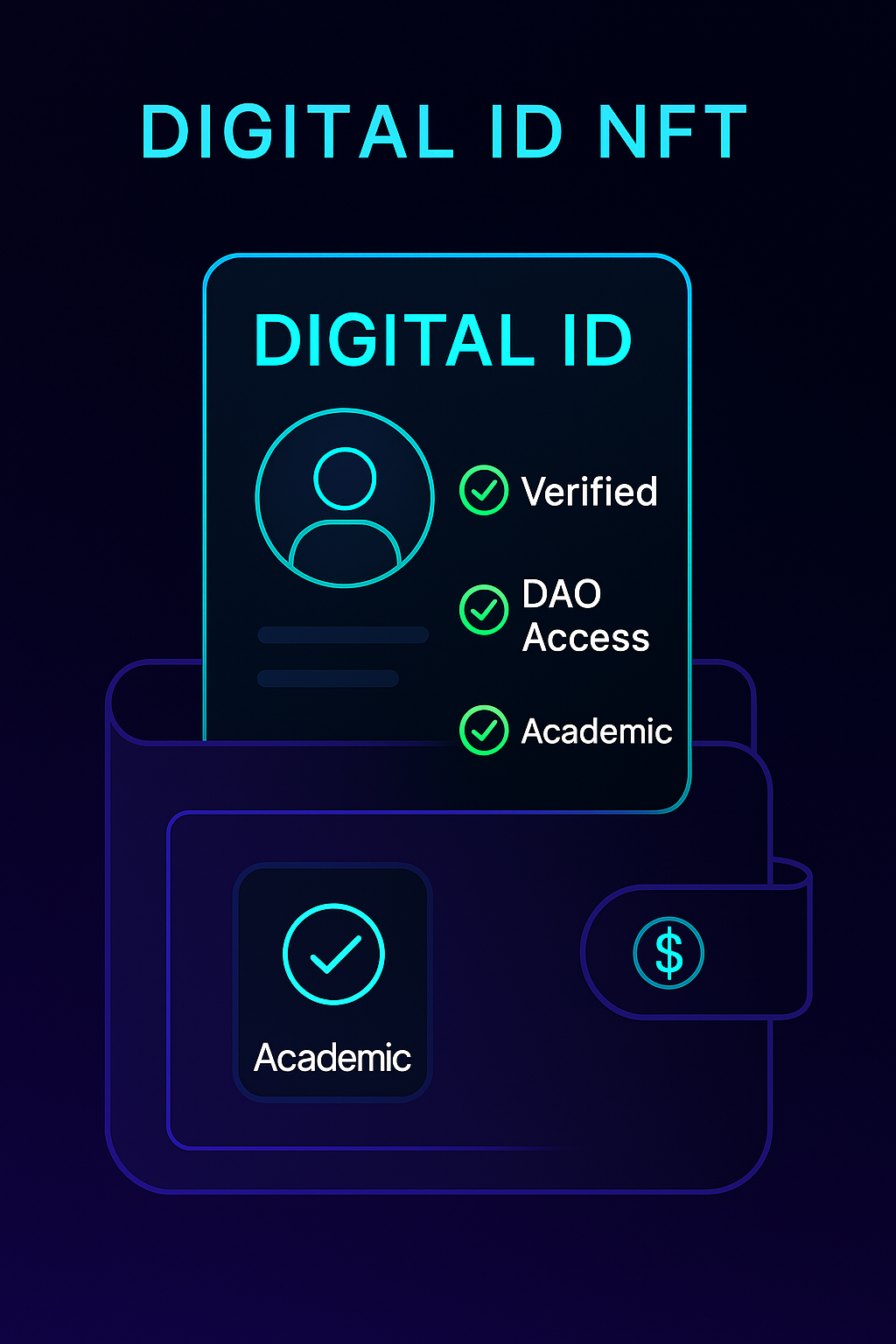

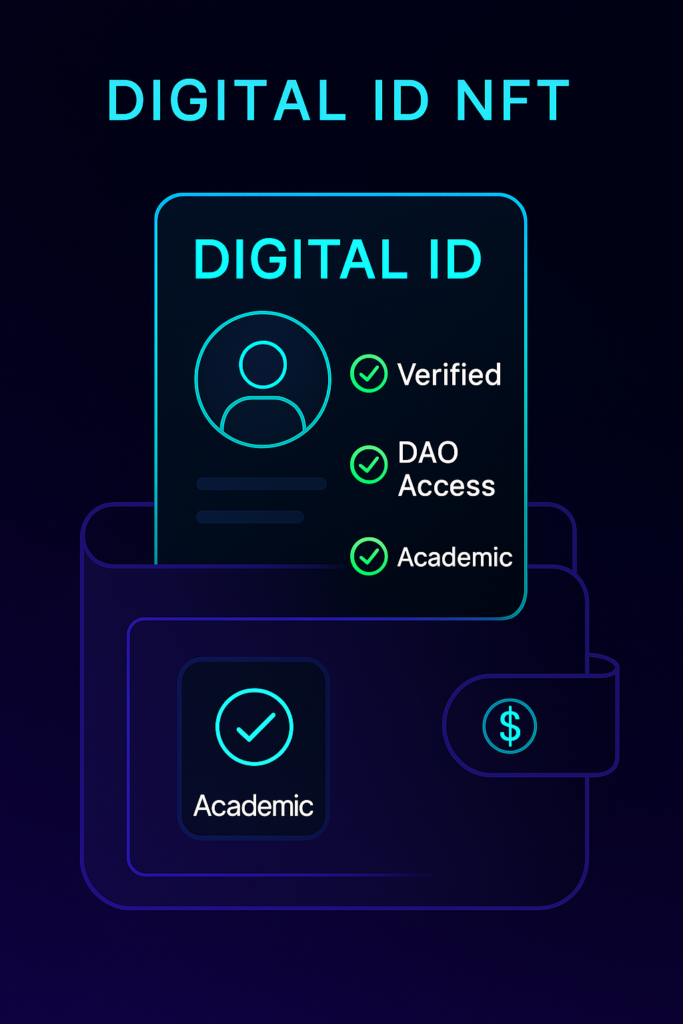

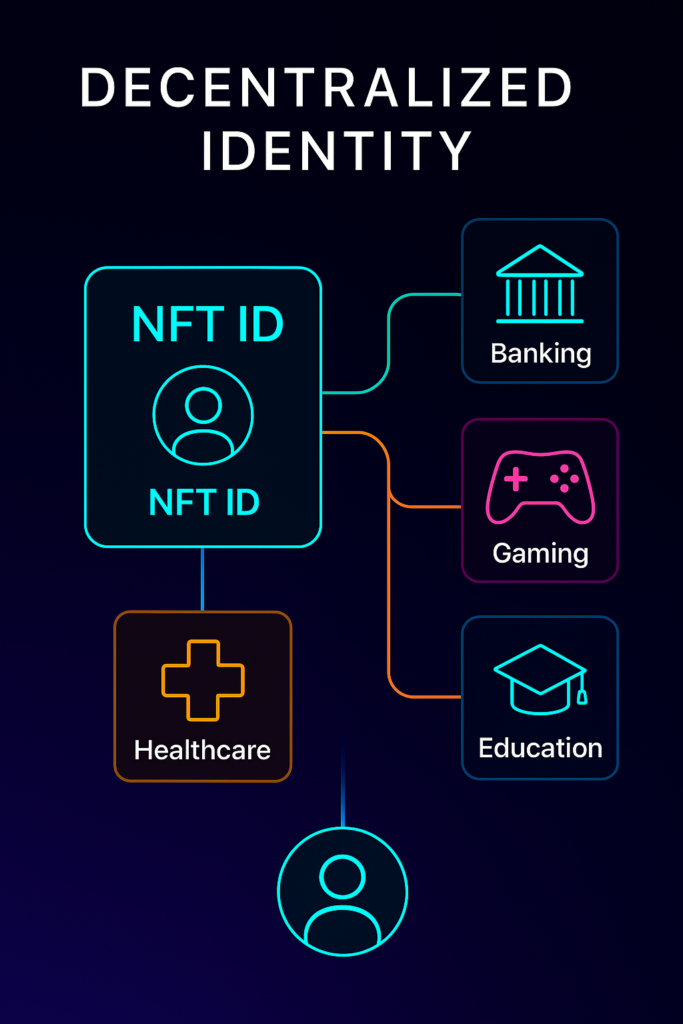

3. Identity and Credentialing

Utility NFTs are now being used to verify professional credentials, achievements, or membership status.

- Soulbound tokens (non-transferable NFTs) can prove educational degrees or skill certifications

- Blockchain-based ID NFTs allow users to prove identity anonymously, yet securely

- DAOs and gated governance systems often rely on NFT-based voting rights

As privacy becomes more important online, NFTs provide a way to confirm without revealing everything.

4. Supply Chain and Product Authentication

Utility NFTs can serve as digital twins for physical goods. These NFTs carry metadata about product origin, ownership, or handling—greatly improving transparency.

Luxury brands like LVMH are already experimenting with NFT-authenticated products. This not only fights counterfeits but also allows second-hand buyers to verify the authenticity of items.

The same approach is being tested in food, pharma, and fashion supply chains.

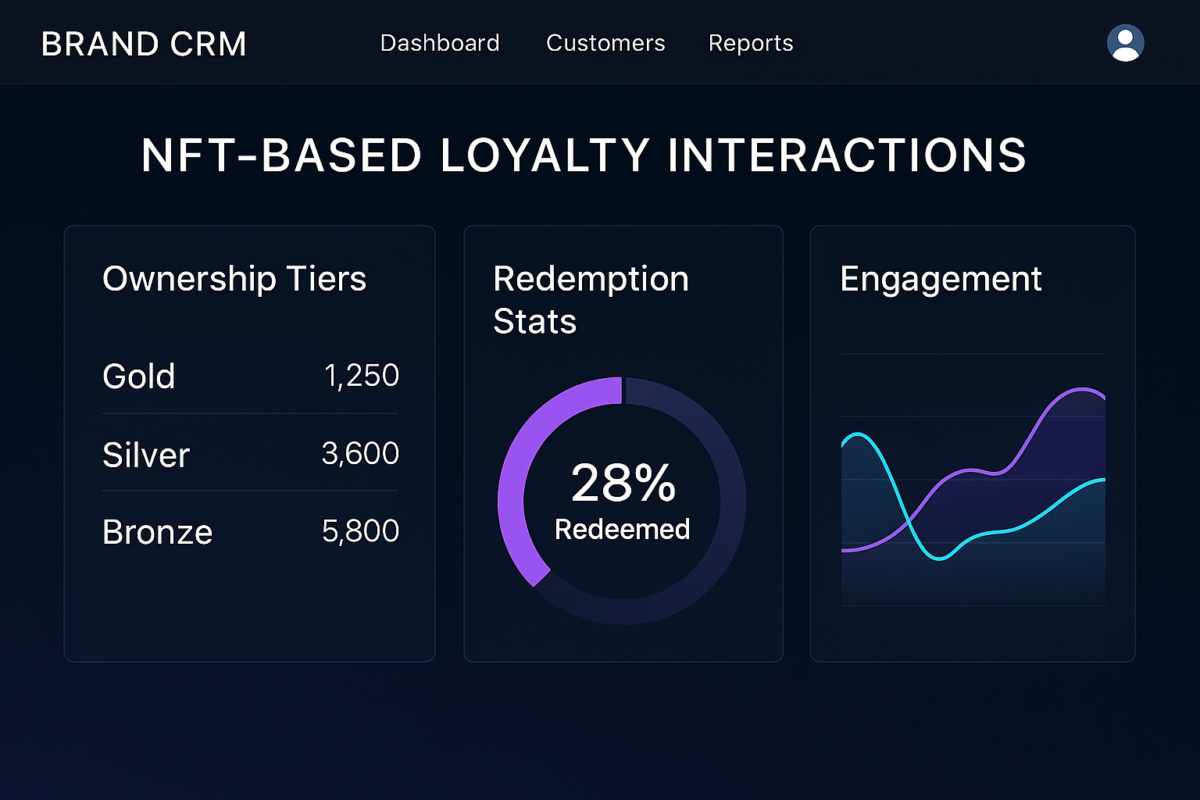

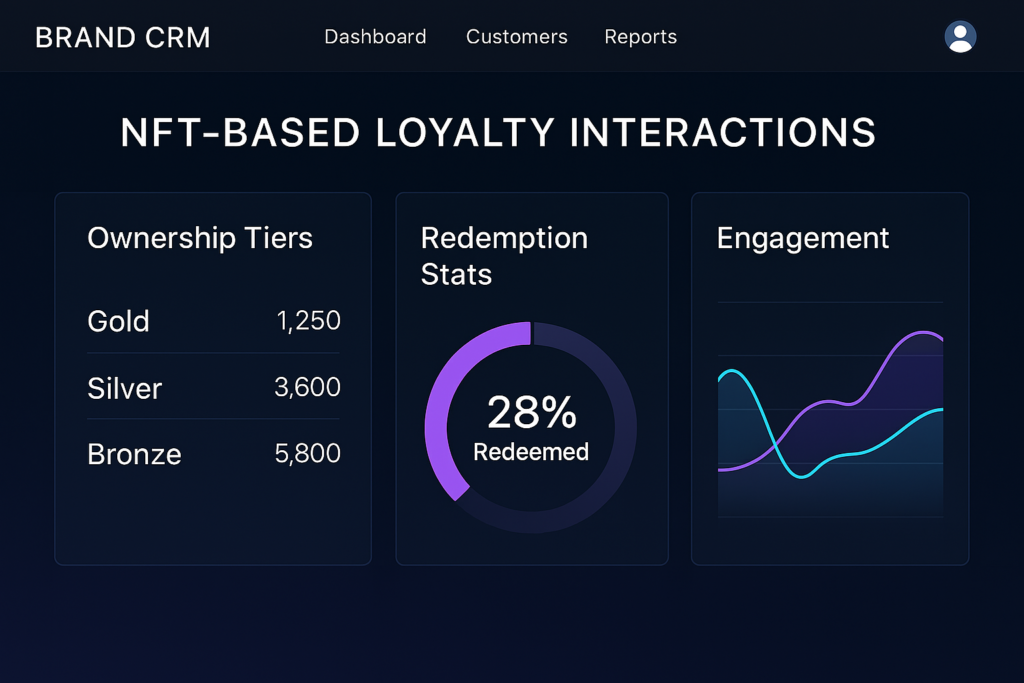

5. Loyalty Programs and Fan Engagement

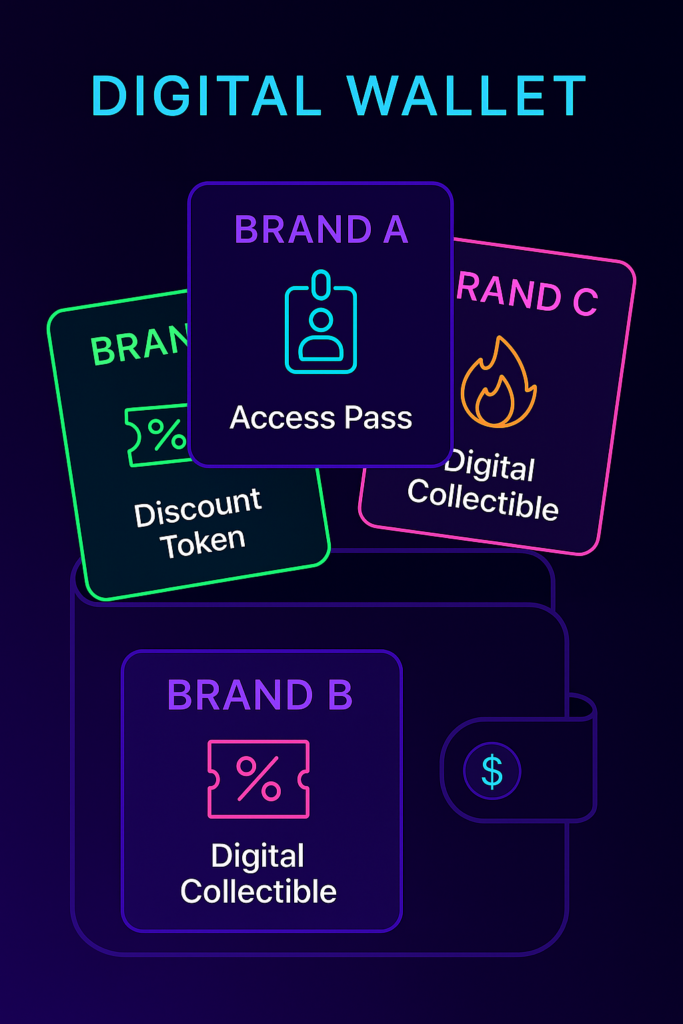

Brands are replacing traditional loyalty cards with NFT-based membership passes. These are dynamic, tradable, and reward users in more creative ways.

- Starbucks’ Odyssey Program uses NFTs as part of its rewards experience

- Sports teams mint fan NFTs offering access to player content, behind-the-scenes videos, or merchandise drops

Because users actually own these NFTs, they’re more emotionally invested. And since they’re on-chain, rewards and histories travel across platforms.

Benefits of Utility NFTs Over Traditional Systems

So why use NFTs at all? Utility NFTs offer benefits that traditional systems can’t match:

- True ownership: Even platforms can’t revoke your access

- Programmability: NFTs can update with new perks or data

- Interoperability: Use one NFT across different apps or games

- Traceability: Every interaction is logged, transparent, and tamper-proof

As blockchain infrastructure matures, these benefits become not just nice-to-have, but necessary.

Challenges to Watch For

Despite their promise, utility NFTs are not without obstacles:

- Scalability: Networks must handle large volumes without congestion

- User experience: Wallets, gas fees, and jargon can confuse non-crypto users

- Regulation: Legal gray areas around ownership, taxation, and IP still exist

- Security: NFT-based access must protect against theft or misuse

However, tools like account abstraction, Layer 2 scaling, and regulatory frameworks are already addressing many of these.

Where Are Utility NFTs Headed Next?

The future of NFTs will likely be utility-first. With fewer speculative projects and more real-world use cases, developers and enterprises alike are focusing on infrastructure.

Expect to see:

- Widespread use in education, hiring, and resume verification

- NFTs as dynamic keys in metaverse platforms

- Deeper cross-brand collaborations where one NFT unlocks benefits in multiple ecosystems

Eventually, users may not even realize they’re interacting with an NFT—only that their experience is smoother, smarter, and more personalized.

Conclusion

Utility NFTs are pushing the Web3 ecosystem toward real functionality. No longer just about art or speculation, these tokens enable access, identity, loyalty, and trust. As the space matures, utility will drive adoption—not hype.

Call to Action

🎯 Curious how your brand can leverage utility NFTs? Download our free guide covering top use cases, integration tools, and compliance insights.

✅ Let me know if you’d like the comma-separated keyword list again, or if we should jump into NFT Blog 2.