Can Data Science Help You Spot Undervalued NFTs?

Doesn’t the NFT market feel like a wild, unpredictable ride? It does, if you only look at the surface. But beneath all the noise and hype is a clear, reliable signal: data. Most people are simply chasing whatever’s trending or picking art they think looks cool. But a smart group of investors is doing something radically different: they’re treating NFTs like a science project, not a casino. They’re using NFT data science to pore over blockchain records, figure out who’s buying what, and spot ownership shifts.

This lets them snag undervalued NFTs before the rest of the world knows they exist. Basically, they’re turning digital art investment from a guess into a highly informed bet.

In this article, we’ll show you how data science uncovers those hidden treasures, tell you exactly which numbers you need to track to value an NFT, and look at the powerful new tools built on blockchain analytics that are shaking up digital asset investing.

The Challenge of NFT Valuation

Unlike stocks or property, NFTs don’t have clear intrinsic value. Their worth comes from factors like artist reputation, community strength, rarity traits, and recent hype cycles. Yet, these factors are volatile and easily manipulated.

Here’s why NFT pricing models are so complex:

Subjective appeal: Aesthetics and personal preference still influence price.

Illiquid markets: Not all NFTs are frequently traded, making price discovery difficult.

Market manipulation: Wash trading and artificial scarcity distort real demand.

Lack of standardization: Each project defines rarity and utility differently.

Data science offers a solution: turn subjective art into objective insight.

Also See: Monkey NFTs: Everything You Need to Know About

What Is NFT Data Science?

NFT data science applies statistical models, algorithms, and machine learning to blockchain data. Instead of relying on hype, it focuses on measurable indicators of value.

This includes:

Transaction analysis: Tracking wallet activity, average holding time, and buying clusters.

Rarity scoring: Comparing traits across a collection to identify outliers.

Pricing patterns: Mapping historical sales to detect undervalued listings.

Sentiment analysis: Using AI to gauge community emotions from social platforms.

Predictive modeling: Estimating future floor prices based on data correlations.

By combining these insights, data scientists can highlight NFTs priced below their likely market value.

How Data Science Spots Undervalued NFTs

Let’s break down how NFT analytics works in practice.

1. Rarity Meets Reality

Every NFT project has “rare” traits but rarity alone doesn’t guarantee value. Data scientists analyze how rarity interacts with actual sales data.

For example:

- If a rare trait consistently sells below the average price, it might be undervalued.

- If common traits perform unusually well, it signals community preference trends.

Tools like RaritySniper or TraitSniper apply this logic to collections, but advanced NFT insights platforms go further by adding context like who’s buying, when, and why.

2. Ownership Patterns

Blockchain records reveal wallet behavior. Long-term holders, “diamond hands,” often signal conviction and community health. If a project shows strong holder retention but temporary price dips, data models may flag it as undervalued.

AI-driven tools assess:

- Holder concentration (whales vs. retail investors)

- Average holding duration

- Wallet overlap across successful projects

These metrics create a behavioral fingerprint for each NFT ecosystem.

3. Volume and Momentum Analysis

Data science identifies patterns that human intuition might miss. Using NFT predictions, analysts track spikes in trading volume before major news or collaborations.

A sudden rise in on-chain activity can foreshadow value shifts. Models similar to those used in crypto analytics detect early signals like volume surges, new wallets interacting, or liquidity inflows that precede a price breakout.

4. Network Graphs and Influence Mapping

NFTs aren’t isolated assets; they live within communities. Blockchain analytics can visualize relationships between buyers, sellers, and influencers.

If a cluster of known “smart money” wallets like those with a history of profitable trades starts accumulating a project, data alerts investors before social media catches on.

This turns market visibility into measurable, actionable intelligence.

Key Metrics for Evaluating Undervalued NFTs

For data scientists, undervalued doesn’t mean cheap, it means mispriced relative to potential. The following metrics help pinpoint true value:

| Metric | Description | Why It Matters |

| Floor Price Deviation | How far a listing is below the collection’s average | Indicates short-term undervaluation |

| Trait Rarity Correlation | Relationship between rarity score and sale price | Highlights undervalued rare items |

| Wallet Holding Strength | How long top holders retain NFTs | Reflects long-term belief |

| Transaction Momentum | Speed and volume of recent sales | Predicts near-term interest |

| Social Sentiment Index | Community tone from Twitter, Discord, Reddit | Anticipates market behavior |

| Historical ROI Curve | Return patterns across similar projects | Projects potential future performance |

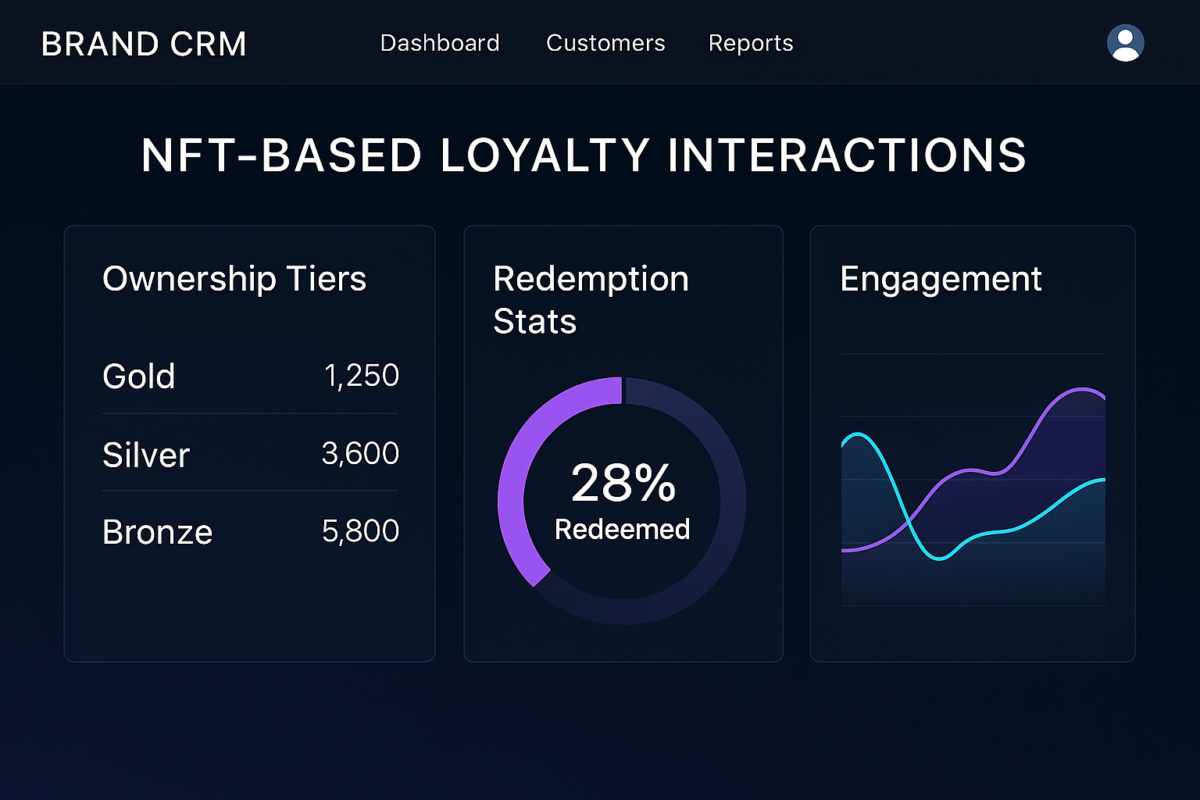

By blending these metrics, NFT analytics platforms like Nansen, Icy Tools, or Dune Analytics provide dashboards that simplify data for investors without coding expertise.

The Role of Machine Learning in NFT Valuation

Machine learning turns raw blockchain data into predictive intelligence.

Here’s how it works

Feature extraction: Models identify variables like rarity, sales velocity, and holder demographics.

Pattern recognition: Algorithms detect trends in price movements or community growth.

Prediction modeling: Systems estimate which NFTs are likely to rise in value.

For example, a data-driven NFT model might flag a collection where low-floor assets have begun trading more frequently than rare ones suggesting upward movement across the board.

This predictive power gives investors an edge in timing entries and exits, much like algorithmic trading in traditional finance.

Benefits of Data Science for NFT Investors

1. Objective Decision-Making

Emotion drives markets but emotions can mislead. Data science anchors decisions in evidence, not hype.

2. Early Discovery

By detecting undervalued assets before public attention spikes, investors gain a first-mover advantage.

3. Portfolio Optimization

Data-driven insights help diversify NFT holdings across high-probability projects instead of speculation.

4. Fraud and Risk Detection

AI models identify suspicious wallet activity, wash trading, or fake volume, reducing the risk of scams.

5. Long-Term Market Understanding

Over time, data patterns reveal how communities evolve and which utilities sustain value, refining future strategies.

The Limitations of NFT Data Science

Even the smartest models have blind spots:

Emotional drivers: Culture, memes, and sentiment can override logic.

New project volatility: Limited data makes early predictions unreliable.

Data quality: Not all platforms track or clean blockchain data consistently.

Model bias: Algorithms reflect the assumptions they’re trained on.

That’s why NFT analytics should guide, not replace, human judgment. Combining technical insight with creative intuition remains the winning formula.

The Future of NFT Analytics

As the NFT market matures, data science will evolve beyond rarity charts into full-fledged valuation ecosystems. Here’s what’s next:

Cross-Chain Data Integration: Analytics that compare assets across Ethereum, Polygon, Solana, and beyond.

Behavioral NFT Models: Predicting buyer intent based on wallet interaction patterns.

Emotional Value Metrics: Using AI to measure how narratives and aesthetics impact price over time.

Decentralized Valuation Protocols: Open-source models where communities collectively assess NFT worth.

The future of digital asset valuation will blend science, psychology, and community dynamics into a new kind of financial literacy.

FAQ: NFT Data Science

Can data science guarantee profitable NFT picks?

No. It improves probabilities, not certainties. Market sentiment still plays a major role.

Are data tools expensive?

Many NFT analytics tools offer free or freemium tiers. Advanced ones, like Nansen or Dune, use subscription models.

Which blockchain has the most NFT data for analysis?

Ethereum remains dominant, but tools increasingly support Solana, Polygon, and Avalanche.

What skills are needed to use NFT data science effectively?

Basic data literacy helps, but many tools provide visual dashboards for non-technical users.

Conclusion

The world of NFTs, notorious for its unpredictability, is finally getting a dose of clarity thanks to data science. Through sophisticated tools like blockchain analytics and machine learning, investors now have a way to cut through the noise: they can identify undervalued assets, accurately measure their risk exposure, and build a much smarter investment strategy.

Looking ahead, the next great phase of NFT investing will be defined by how well we merge the rigor of data with the subtlety of human intuition. Investors who can effectively interpret the data woven into the artwork itself will be the ones leading the market, not just following the crowd.