On-Chain vs Off-Chain Data in NFT Architecture

When we say an NFT is ‘on the blockchain,’ we aren’t telling the whole story. Most NFTs actually function across multiple layers: some data is recorded on-chain, but a significant portion often lives elsewhere. This design has huge implications for trust and long-term value. Whether you’re building a platform or collecting art, it’s vital to understand the difference between on-chain and off-chain storage, it’s often the only thing standing between an asset that lasts forever and one that vanishes overnight.

In this article, let’s break down how NFT data is structured, how storage layers work, and why the difference matters more than most people realize.

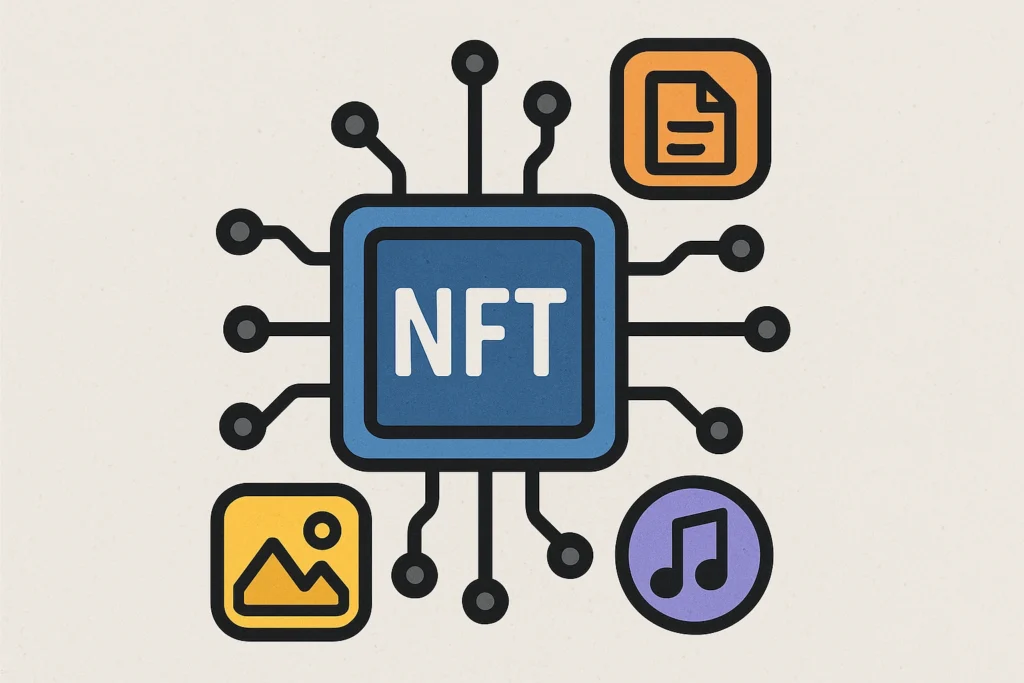

What Data Makes Up an NFT?

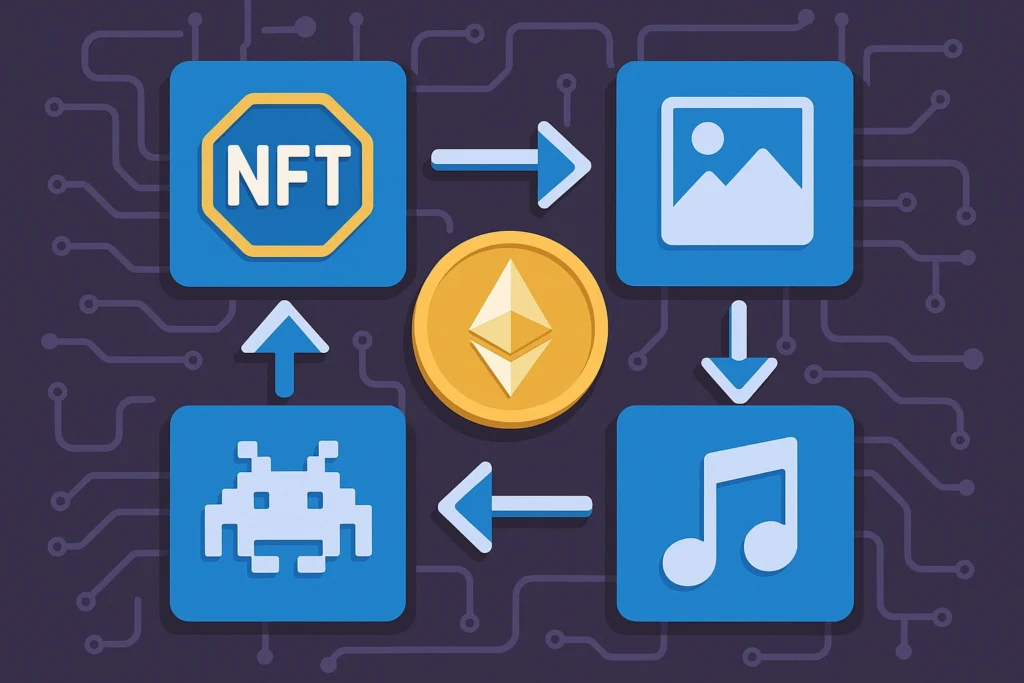

An NFT is not a single digital object. It is a structured record that connects ownership to content. The blockchain stores the token identifier, the smart contract logic, and the ownership history. What it usually does not store is the actual image, video, or audio file. Instead, the blockchain holds a reference that points to where that file lives. This separation exists because blockchains are expensive environments for data storage.

Keeping large media files on-chain would make NFTs prohibitively costly. As a result, storage architecture becomes a core part of NFT design rather than a technical afterthought.

What Is On-Chain NFT Storage?

On-chain storage means that the NFT’s data is written directly into the blockchain itself. When this approach is used, the NFT does not depend on external servers or networks to exist. As long as the blockchain continues to operate, the NFT remains accessible and verifiable. This provides a high level of permanence and resistance to censorship.

However, storing data on-chain comes with significant limitations. Blockchains were not designed for heavy media storage, and costs increase rapidly as file size grows. Because of this, fully on-chain NFTs tend to be minimal in size and complexity.

Fully On-Chain NFTs

Fully on-chain NFTs often rely on generative or encoded content rather than traditional media files. The artwork may be generated from code stored in the smart contract or represented through compressed data formats. This approach ensures that the NFT is entirely self-contained and immune to external failures. Nothing can be removed or altered without changing the blockchain itself. While this provides unmatched durability, it also restricts creative freedom. High-resolution images, animations, and video content are rarely feasible using this model, which limits its use to specific artistic styles and technical experiments.

What Is Off-Chain NFT Storage?

Off-chain storage refers to any architecture where the NFT points to data stored outside the blockchain. In this setup, the blockchain acts as a record of ownership and reference, while the actual content is hosted elsewhere. This allows NFTs to include rich media without overwhelming blockchain infrastructure. Off-chain storage makes NFTs more flexible and affordable, but it introduces dependency. If the external storage fails, the NFT can lose access to its content even though the token itself still exists.

Decentralized Off-Chain Storage

To reduce reliance on centralized servers, many NFT projects use decentralized storage networks. These systems store files across multiple nodes rather than in a single location. Files are identified by cryptographic hashes, meaning the content itself determines how it is retrieved. This design ensures that files cannot be secretly altered without detection. Decentralized storage improves resilience and aligns more closely with blockchain principles, but different networks offer different guarantees around permanence and availability.

IPFS: How It Works

IPFS is one of the most commonly used decentralized storage systems for NFTs. It allows files to be distributed across a peer-to-peer network and retrieved using a unique content hash. This ensures that the file retrieved is exactly the file that was originally uploaded.

However, IPFS does not automatically guarantee that files will remain available forever. Files must be actively hosted, or pinned, by users or services. If no one continues to host the data, it can eventually become unavailable. This means IPFS reduces risk but does not eliminate it entirely.

Arweave: Permanent Storage by Design

Arweave takes a different approach by designing its network around permanent storage. Instead of requiring ongoing hosting, users pay once to store data indefinitely. Economic incentives encourage network participants to keep data available over the long term. For NFTs, this model provides stronger assurances that files will not disappear. Once an NFT file is stored on Arweave, it is intended to remain accessible as long as the network exists. This makes it especially attractive for high-value NFTs and cultural assets where permanence matters more than flexibility.

IPFS vs Arweave: A Practical Comparison

IPFS is flexible and widely adopted.

Arweave is rigid but permanent.

IPFS is better for:

- Large collections

- Cost-sensitive projects

- Dynamic metadata

Arweave is better for:

- High-value NFTs

- Long-term archives

- Cultural preservation

Both are forms of decentralized data storage, but they serve different priorities.

Choosing between them is a design decision, not a technical one.

Also See: Cognitive Cryptography: How the Mind Interprets Digital Ownership and Value

Metadata and Its Importance

Metadata defines what an NFT is beyond ownership. It includes the name, description, traits, and references to the media file. If metadata changes, the perceived identity of the NFT changes as well. Some NFTs allow metadata updates, while others permanently lock it. Mutable metadata enables growth and experimentation, but it also introduces uncertainty. Immutable metadata provides stability but limits adaptability. How metadata is stored and managed plays a major role in trust and valuation.

Why Storage Architecture Affects NFT Value

Collectors increasingly evaluate NFTs based on their technical foundations. An NFT backed by strong, permanent storage inspires more confidence than one dependent on fragile infrastructure. Storage architecture influences whether an NFT can survive platform failures, legal disputes, or technological shifts. As awareness grows, architecture becomes part of an NFT’s narrative and value proposition. Long-term collectors pay attention to where data lives, how secure it is, and whether it can endure.

Storage Layer Transparency Matters

Good NFT projects explain their storage choices.

They disclose:

- Where files are stored

- Whether metadata is mutable

- How permanence is ensured

This transparency builds trust. Projects that hide storage details raise red flags. Even strong art cannot compensate for weak infrastructure. In NFT architecture, silence is a risk.

Hybrid Storage Models

Many NFT projects adopt hybrid approaches that balance cost, performance, and durability. Ownership records remain on-chain, metadata may be stored on IPFS, and media files may be archived on Arweave. This layered approach reflects practical constraints while preserving long-term value. Hybrid models recognize that not all data carries equal importance. Critical elements receive the strongest protection, while less critical components remain flexible.

Long-Term Implications for NFT Hosting

As the NFT market matures, expectations around storage will continue to rise. Collectors are becoming more technically informed and less tolerant of weak infrastructure. Platforms and standards are evolving to emphasize permanence, decentralization, and transparency. In the future, storage architecture will likely become a defining feature of NFT quality rather than an invisible detail.

Conclusion

We need to stop viewing NFTs as just images and start seeing them as data architecture. Whether a project stores data on-chain or off-chain tells you everything you need to know about its long-term viability. As the market moves past the initial gold rush, buyers are looking for substance over hype. True value belongs to the projects designed to survive the test of time, not just the current cycle.

FAQ: On-Chain vs Off-Chain

Are NFTs fully stored on the blockchain?

No. Most NFTs store ownership on-chain and files off-chain.

Is on-chain NFT storage better?

It offers maximum permanence but limits media complexity.

Is IPFS permanent?

Only if files are actively pinned. Otherwise, availability is not guaranteed.

Why do people prefer Arweave for NFTs?

Because it is designed for permanent storage with long-term incentives.

Does storage affect NFT price?

Yes. Strong storage architecture increases trust and long-term value.